HPSP Financial Analysis Calculator: Federal Loans vs HPSP Scholarship For Dental School

Financial Analysis Calculator Spreadsheet Created by Carl P., 2d Lt, USAF Dental Corps ’22

Introduction

As long as the Health Professions Scholarship Program (HPSP) has been around, people have asked the question “What makes more financial sense to fund a dental education, the private sector route or the HPSP scholarship route?” A quick internet search produces a wide variety of answers to this question. Accountants have offered up anecdotal evidence based on dental providers they have worked with from both sectors. Practicing dentists are quick to give their own opinion, often highly polarized to one side or the other. Dental students make claims such as “Dentists can make way more money in the private sector” or “The military route is sure to save you more money in the long run”. Everyone has heard stories of private practice dentists who are dominating the local market. Likewise, many people know a prior military dentist who is now in private practice and doing extremely well. It is no wonder why no one can agree on which route is the better choice from a strictly financial perspective.

As no comprehensive financial analysis of the HPSP scholarship has previously existed, Laptops For Military Docs sought to provide such an analysis for prospective and current dental students to use in making critical decisions regarding the funding of their dental education. Working closely with a student who has an extensive background in the formulation of complex Excel spreadsheets, as well as an advanced understanding of finances, an in-depth financial analysis for funding dental school was created.

With its completion, the Laptops For Military Docs HPSP Financial Analysis Calculator is the most comprehensive and accurate analysis that exists for comparing the private sector route to the HPSP scholarship route for financing a dental education.

This analysis provides the following capabilities:

· Comparison for a wide variety of scholarship and private sector scenarios.

· Calculation of equivalent private sector income necessary to make both the private route and military route financially equal. A private sector income above this value would make the private route more advantageous. A private sector income below this value would make the military route more advantageous.

· Heat map summary table showing which route is more beneficial given the cost of attendance, and expected private sector income upon graduation.

Laptops For Military Docs hopes that this financial analysis will be beneficial to many in making decisions about the funding of their education. We are excited about the value this provides to students and appreciate the effort by 2d Lt Carl P. for making this possible. For any suggestions on making this analysis more accurate, please reach out to us at support@laptopsformilitarydocs.com

Discussion

Most people would agree, without needing a detailed spreadsheet, that the HPSP scholarship is financially more beneficial for students attending private schools, due to the high cost of tuition and fees that generally exist at private institutions. A dental education at a private school such as Midwestern University in Glendale, Arizona in 2021 costs nearly $100,000 in tuition, fees, and insurance alone. Living expenses are estimated to be an additional $32,507 making the total annual cost of attendance around $130,000. Assuming a 4% annual increase due to inflation, it costs a student approximately $550,000 to graduate from Midwestern Dental School. Direct and Direct PLUS loans are not subsidized, meaning that interest accrues while in school. At 4.3% and 5.3%, respectively, this adds up very quickly. If someone chooses to do a 1-year residency after graduation, the initial debt at graduation of $550,000 increases to over $630,000 by the time the residency is completed, BEFORE the student can even begin paying off the loans.

With the HPSP Scholarship, all educational costs are covered for the number of years a student is on the scholarship. This is a value of up to $600,000 depending on the school attended. Not all dental schools, however, are as expensive as private schools like Midwestern. In fact, state schools are considerably less expensive. In particular, Texas state schools are known for having extremely low costs of attendance. The total cost to attend the average state dental school is close to $250,000. This is around half the cost of private schools.

Due to the relatively low cost of attending a state school, many prospective dental students believe or have been encouraged to believe that if you will be attending a state school, the HPSP scholarship isn’t worth it financially. The belief is that state schools are inexpensive enough to be able to pay off federal loans on your own, and still have a very good income coming out of dental school. The following thought has likely passed through the minds of countless students: “Since so many dentists are able to survive having graduated from a private school, if I am able to attend a state school and graduate with way less debt than they did, then I should be able to survive just fine. I, therefore, don’t need the HPSP scholarship!” For some, this is the extent of thought they lend toward the HPSP scholarship, which is fine because they may not have been truly interested in it in the first place. However, others who are genuinely interested in the scholarship have put more thought into the decision.

Many prospective students have realized, with more attention to the details, that the financial benefit of the HPSP Scholarship isn’t black or white. They realize that it isn’t as simple as saying “If you attend a private school, apply for the HPSP Scholarship, and if you get accepted to a state school then the HPSP scholarship isn’t worth it.” There are more gray areas than one would anticipate just looking at the HPSP Scholarship on the surface. Some students have come to the conclusion that the HPSP Scholarship is financially more beneficial than federal loans, even when attending a state school. Other students have had a hard time determining which route is better from a financial perspective, maybe due to the fact that both routes were almost equal for their given situation.

Indeed, the salary of a military dentist is generally lower than the private sector. When factoring in base salary, housing and living allowances, incentive pay, and other “hidden” income (tax savings, no-cost health insurance, military discounts, etc.), the income on average for a military dentist in the first five years after graduation is about $120,000 per year. This salary is applicable even while participating in military-sponsored residencies, whereas civilian residencies provide a much less generous stipend. It is important to consider that although the pay might be lower in the military, the benefit of being debt-free can’t be discounted. A dentist in the private sector needs to make a certain amount of money above the salary of a military dentist in order to pay down student loans, and still have an equivalent expendable income as a military dentist. For example, a private practice dentist could make $200,000 per year, but if they have $700,000 in student loans, then this income isn’t as great as it sounds. In fact, the amount of income left over for spending purposes after loan repayments are made each year could end up being less than what a military dentist makes each year.

In theory, the sky is the limit for a private practice dentist, with new grads reporting incomes between $60,000 and $400,000 per year. Every prospective dental student believes they will be the one who makes closer to $400,000 per year, and maybe they will. If they enter private practice, they won’t be limited by a salary cap, as they would in the military. However, a good personality or a successful track history in academics doesn’t always equate to a high income in the first few years after graduation.

With all this said, the goal of the Laptops For Military Docs HPSP Financial Analysis Calculator is to give students tangible numerical evidence as to which route would be more financially beneficial for their own situation heading into dental school. The goal of this analysis is NOT to encourage or discourage students from taking one route or the other. It will simply provide factual evidence, to debunk or support some of the myths and beliefs regarding the HPSP Scholarship, and help students make well-informed decisions. Students will find that for some scenarios, the HPSP scholarship is more financially beneficial, and for other scenarios, the private sector route is more financially beneficial. Certain circumstances may show that both routes are equally beneficial from a financial perspective. No matter the outcome of the analysis, the student will ultimately have the power to decide which route to take. This is just one more tool to aid in making the final decision. Let’s get started!

Important Points of Understanding for the Financial Analysis Spreadsheet

For comparison purposes, the following assumptions were made in order to level the playing field between the military route and the private sector route and provide the most accurate comparison:

· If you go the military route, you will enter private practice immediately after completing your initial military service commitment

o At the moment in time you enter private practice after leaving the military:

§ You are just as prepared to make money moving forward in private practice as someone who has been in private practice the same amount of time you were in the military.

§ You are debt-free in regards to costs related to funding your dental education. (Some HPSP students take out extra loans for living expenses during dental school in cities with a high cost of living)

o Money paid by the military for tuition, as well as the stipend provided to military students, are not viewed as income for purposes of the final comparison. Since students who take the private sector route have to take out loans for tuition and living, this is viewed as debt to fund their education. Students who take the military route, essentially have no debt to fund their education, but the stipend is not considered income in the final comparison.

· If you go the private sector route, you will become debt-free at the same moment in time you would have finished your initial military service commitment and entered the private sector.

o You are debt-free in regards to costs related to funding your dental education. Other debts such as home purchases, practice purchases, etc. are not considered in this analysis.

The overarching assumption is that in both scenarios – the private sector route, and the military route, the student will be debt-free at the same point in time (when you will have completed your initial military service commitment in a given scenario) and you will have the same earning capability in the private sector moving forward.

· Example: If you are offered a 4 yr dental scholarship from the military and don’t plan on doing a residency with the military, then you will be done with your military commitment 4 yrs after graduating from dental school. With this analysis, you are assuming after 4 years of being a dentist (when you would be done with your initial military payback) you would be debt-free whether you took the military route or went the private sector route. This means for the private sector route, in this 4 year period of time you would need to pay off all of your school loans in order to make the comparison valid.

o It may seem unrealistic to expect a private practice dentist to be debt-free in 4 yrs (as portrayed in the example above). However, this is the only way to make a legitimate comparison between the private sector and military routes. It has to be determined that at the same moment in time, under both scenarios the person would be in the same financial position moving forward. For the purpose of this analysis, it was decided to set that moment in time equal to the moment when the person would be done with their initial military service commitment.

Download the Laptops For Military Docs HPSP Financial Analysis Calculator Spreadsheet and follow along using the directions below!

How the Analysis Works

When you first open the spreadsheet, if you see a security warning box at the top, click the "Enable Editing" button and then the "Enable Content" button in order for the spreadsheet to work properly.

The spreadsheet requires the user to review five different sections. The values inputted within these sections allow the spreadsheet to create a financial comparison between the private sector route and the military route. Users should input values based on scenarios they anticipate for their own education. For example, if a user only has an acceptance to one dental school, then the costs to attend this school should be used to create the financial analysis. If a user has multiple dental school acceptances, then a different analysis can be created for each school. However, the analysis can only evaluate one dental school at a time.

Color Key

· Green cells are cells that the user is required to input values in.

· Blue cells are variable values based on data collected through credible sources and do not need to be altered. If you find a source that lists a more accurate value for a certain blue cell, you may alter the value if you wish.

· White and Yellow cells are calculated by the spreadsheet and should not be manually altered. If you accidentally input a value in another cell, undo the action, or close out the spreadsheet without saving and start over.

o Yellow cells are highlighted yellow for emphasis only, as they show a value that may be particularly useful to know in making financial decisions.

Sections Requiring Input from User

Section 1: Dental School & HPSP Scholarship Information

· Input school information

o Graduation year

o Dental Program length

§ This should be 4 yrs unless you attend UOP where the program length is 3 yrs.

o First Year Cost of Attendance

§ Include tuition, fees, and cost of living. The actual cost of attendance for a given dental school can usually be obtained from the dental school’s website.

§ Cost of attendance values provided by dental schools already include origination fees for federal loans.

§ The spreadsheet will automatically calculate the cost of attendance for the remaining years of school based on the annual inflation rate listed in section 2.

· Input civilian route scenario (input based on what you think would happen if you were to go the civilian route)

o Input if you expect to do a 1 yr civilian AEGD or GPR residency

§ Y (Yes), N (No)

o If you selected Yes for a 1 yr civilian AEGD or GPR, input anticipated annual stipend (income) during the civilian residency.

o Total Years as a Civilian Dentist After Residency

§ This value is calculated automatically so that the time spent in a civilian residency and the time spent as a dentist after a civilian residency equals the total time spent in the military as a dentist.

· Input military scenario (if you were to go the military route)

o Expected HPSP scholarship length in years

o Input if you expect to do a 1 yr military AEGD or GPR residency

§ Y (Yes), N (No)

o Total Years in Military

§ This value is automatically calculated to determine the total amount of time you are required to be in the military based on scholarship length, and whether you do a 1 yr residency or not. This length of time determines the length of time that will be used for the final comparison presented in the spreadsheet.

§ Note that if you selected a 2 yr scholarship length, the total time in the military will automatically default to at least 3 years, as this is the minimum payback commitment for the HPSP Scholarship.

Section 2: Federal Loan Information

· Input whether you would refinance your loans (if you were to go the civilian route)

o Y (Yes), N (No)

· Input anticipated refinanced interest rate

o Feel free to leave this value at 3% unless you would like to use a different value

Section 3: Cost to Fund Dental School Through Federal Loans

· No values should be inputted in this section

· Values in this section are calculated based on values inputted in previous sections.

· This section gives a breakdown of the total amount borrowed under the Direct Loan and the Direct PLUS Loan assuming that you took out enough loans to completely cover the cost of attendance. It also shows the accumulation of interest each year and provides a total debt amount the student would graduate with (emphasized in yellow)

· The Total + Interest After Each Year section is the result of figuring out how much of each type of loan would be disbursed every quarter so that accurate interest calculations can be made.

Section 4: Cost to Fund Dental School Through HPSP Scholarship

· Input additional funds needed to cover living expenses each year while on the HPSP scholarship.

o Most students on the HPSP scholarship won’t be allowed to borrow additional funds for living, because the estimated cost of living for the area they live is less than the stipend provided by the scholarship (stipend is around $30,000).

o If the student attends school in an expensive city such as Los Angeles, San Francisco, New York, Boston, etc., then the cost of living estimated by the dental school may be more than the $30,000 stipend provided by the scholarship. If this is the case, and you anticipate borrowing more to cover the cost of living in an expensive city, then input the amount you will need to borrow each year.

o If you don’t need to borrow additional funds then leave the green input cells blank.

§ Students living in a city with a low cost of living likely won’t borrow additional funds on the HPSP scholarship.

§ Students with a spouse working likely won’t borrow additional funds.

· If you input additional funds needed in the green cells, this section will give you a breakdown of the total amount borrowed under the Direct Loan and the Direct PLUS Loan. It also shows the accumulation of interest each year and provides the total debt amount the military student would graduate with (emphasized in yellow) as well as the final amount paid toward that debt by the time the student completes their initial military service commitment (also emphasized in yellow)

· Input the signing bonus amount you would receive if you go the military route

o Army and Navy HPSP dental scholarships provide a $20,000 signing bonus.

o Air Force HPSP does not provide a signing bonus for dental school scholarships.

· The values in the blue cells are military income and compensation values based on data current in 2021.

o The average BAH (basic allowance for housing) for all zones (assuming WITH dependents), added to the BAS (basic allowance for subsistence) is included here. It was assumed that BAH and BAS would both increase at 2.1% annually.

o Yearly incentive pay for a general dentist in the military is $20,000.

o The annual value of benefits was arbitrarily determined to be $10,000 which include health and life insurance, tax savings, military discounts, etc. This value may actually be higher, but a low estimate was determined to not give the HPSP scholarship route any extra advantage in the final comparison.

· Current base pay for O3 officer pay grade (Captains in the Air Force and Army, and Lieutenants in the Navy) are provided using 2021 military pay data.

· The annual gross income corresponding to each year of the initial military service commitment is calculated using 2021 military pay data, projected forward to the first year you would work as a military dentist using average inflation rates.

o The total income earned while working as a military dentist is calculated and emphasized in yellow.

Final Results Section: Comparison

· At the top of the comparison section, it will be titled according to the total amount of time you would be committed to the military, and the total amount of time that the spreadsheet will be using for the final comparison.

o Examples:

§ If you were to go the military route, and you have a 4-year scholarship, and you also do a 1-year residency, then the total time you would be committed to the military is 5 years. The title of the comparison section would read “5 Year Comparison”.

§ If you were to go the military route, and you have a 3-year scholarship, and you don’t do a residency, then the total time you would be committed to the military is 3 years. The title of the comparison section would read “3 Year Comparison”.

· The comparison length listed at the top of the comparison section is the length of time used to make the final comparison between the military route and the private sector route.

o The assumption for the final calculations is that after this length of time, you would be debt-free from dental school loans in both the military route and the private sector route.

· The “Average Military Annual Expendable Income After Debt Repayments” is a constant value that's dependent on the values inputted in the first four sections. This value is calculated as an average expendable income over the length of the comparison time stated in the comparison title.

o An expendable income is the income you will have available to you after your school loan payments have been paid each year.

o For example, if the comparison length is 5 yrs, and the spreadsheet calculates that a military dentist will make $500,000 in that 5 year period of time, then the average expendable income per year is $100,000.

o If you inputted that you would take out extra loans to cover living expenses while you have the HPSP scholarship, then these loans will be factored in and deducted from the average yearly expendable income so that you are debt-free by the end of the comparison time frame of 5 years. Your resultant average annual expendable income will be lower because some of your money each year will need to be paid toward loans.

· The “Average Civilian Annual Expendable Income After Debt Repayments” is dependent on the expected civilian annual gross income that the user inputs in this section. This value is calculated as an average expendable income over the length of the comparison stated in the comparison title.

o An expendable income is the income you will have available to you after your school loan payments have been paid each year.

o The spreadsheet has already determined the total amount of school loans that need to be paid off over the course of the comparison. This amount is divided among each year of the comparison and deducted from the average civilian gross income.

§ For example, if you need to pay off $500,000 in loans in order to be debt-free in 5 years, then you will need to pay an average of $100,000 per year toward your loans. If your average gross income is $250,000 then after you pay $100,000 toward your loans each year, you will only have an annual expendable income of $150,000.

· Input expected annual gross income you will receive as a private sector dentist

o Gross income is the total amount you will make each year, before paying any of it to your school loans.

o If you believe you will make an average gross income of $200,000 per year over the length of time of the comparison, then input this into the green cell titled “Expected Civilian Annual Gross Income”

· After inputting an expected annual gross income, evaluate the “Average Civilian Annual Expendable Income After Debt Repayments”.

o This value is the total amount of expendable income you will have each year in order to pay off your school loans over the comparison length of time.

· Compare the “Average Civilian Annual Expendable Income After Debt Repayments” to the “Average Military Annual Expendable Income After Debt Repayments” to determine which scenario would give you a better standard of living during the comparison length of time.

o If the civilian value is only $70,000 per year and the military value is $120,000 per year, then you would have an extra $50,000 in spending or investing power per year if you go the military route, given the information you have inputted into the spreadsheet.

o If the civilian value is $140,000 per year and the military value is $120,000 per year, then you would have an extra $20,000 in spending or investing power per year if you go the civilian route, given the information you have inputted into the spreadsheet.

· Evaluate the “Final Comparison” Value

o This value is calculated based on the “Average Civilian Annual Expendable Income After Debt Repayments” and the “Average Military Annual Expendable Income After Debt Repayments”.

§ This value calculates the annual difference in expendable income between the two scenarios and calculates the total difference in income over the comparison length of time.

· If you have an extra $50,000 per year in expendable income by going the military route, and the comparison length of time is 5 years, then the final comparison value is 5 x $50,000 or $250,000. This means that by the time you are done with your initial military service commitment, you will have an extra $250,000 to your name than you would have if you went the civilian route, given the scenario inputted into the spreadsheet.

· If you have an extra $20,000 per year in expendable income by going the civilian route, and the comparison length of time is 3 years, then the final comparison value is 3 x $20,000 or $60,000. This means that by the time you would be done with your military commitment, you would have had an extra $60,000 to your name if you went the private sector route than you would have if you go the military route, given the scenario inputted into the spreadsheet.

o If the Final Comparison cell states “HPSP Advantage”, and the value is GREEN, then with the given scenario you inputted, it would be more advantageous to go the military route.

o If the Final Comparison cell states “HPSP Disadvantage”, and the value is RED, then with the given scenario you inputted, it would be more advantageous to go the private sector route.

· Test different “Expected Civilian Annual Gross Income” values to see how the final comparison is affected.

o Do you need a really high civilian income to make the civilian route more advantageous?

· Click the “Find Equivalent Civilian Income” button.

o You may have to click this button twice to activate it.

o By clicking this button, the Final Comparison value will turn YELLOW. This is because the spreadsheet has set this value to zero. A zero value in the final comparison denotes that the military route and civilian route are equally beneficial to each other.

o The “Average Military Annual Expendable Income After Debt Repayments” and the “Average Civilian Annual Expendable Income After Debt Repayments” should be equal after clicking the “Find Equivalent Civilian Income” button.

§ The spreadsheet has set these values equal to each other, which really means that the civilian income was set equal to the military income since the military income is a constant value.

· After clicking the “Find Equivalent Civilian Income” button, evaluate the “Expected Civilian Annual Gross Income” value.

o This value shows the exact amount of gross income a private sector dentist would need to earn on average each year throughout the comparison length of time, in order to have the same amount of expendable income as a military dentist, given the scenario inputted into the spreadsheet.

o If the comparison length of time is 5 years, and the value shown here is $200,000 then the user would need at least an average gross income of $200,000 per year over the course of 5 years after graduating from dental school, in order to have the same amount of expendable income as they would have had if they went the military route.

§ This is an average value, so if you only make $150,000 your first year in private practice, you would need to make more than $200,000 in the years two through five in order to make the average gross income equal $200,000.

· Now that the user knows the “Expected Civilian Annual Gross Income” necessary to make both the private sector and military routes financially equal to each other, values above and below this value can be tested to see how it affects the “Final Comparison”

o If the “Expected Civilian Annual Gross Income” necessary to make both routes financially equal is $200,000 then a value above this would make the Private Sector route more advantageous.

§ Try inputting a higher value and notice that the Final Comparison will show HPSP Disadvantage with a RED value.

· The value shown in RED under HPSP Disadvantage is the total amount of extra money you will earn as a private sector dentist compared to a military dentist over the comparison length of time, given the scenario inputted in the spreadsheet.

§ Try inputting a lower value and notice that the Final Comparison will show HPSP Advantage with a GREEN value.

· The value shown in GREEN under HPSP Advantage is the total amount of extra money you will earn as a military dentist compared to a private sector dentist over the comparison length of time, given the scenario inputted in the spreadsheet.

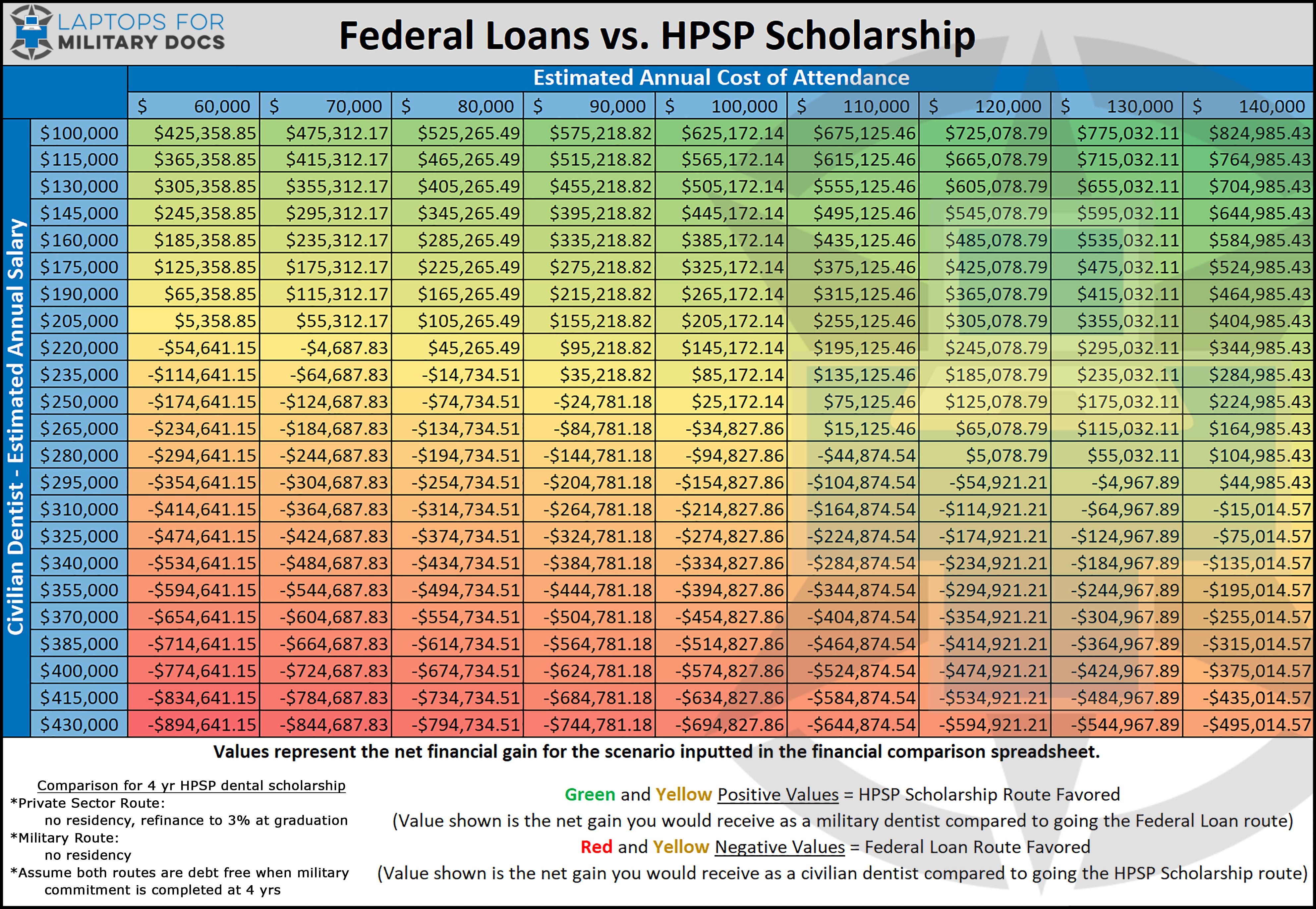

Heat Table

At the bottom of the spreadsheet, there is a second tab titled “Heat Table”. Click on the tab, and then click the “Recalculate” button on the right side of the page.

· This table provides students with an objective analysis of the value of the HPSP scholarship, given a range of private sector incomes and dental school costs of attendance.

· The green and yellow positive values represent net financial gain by going the military route over the private sector route.

· The red and yellow negative values represent net financial loss by going the military route over the private sector route. Another way of looking at this is that the red and yellow negative values represent a net financial gain by going the private sector route over going military route.

· Remember that this gain or loss is calculated at the moment that you would complete your initial military service commitment and enter the private sector.

A quick glance at the chart's greenest value, or reddest value helps make sense of the data being presented.

· For the greenest value (top right corner), where the annual cost of attendance is extremely high and the annual private sector income is low, it would have been much more beneficial to go the military route.

· For the reddest value (bottom left corner), where the annual cost of attendance is low and the annual private sector income is high, it would have been much more beneficial to go the private sector route.

· For yellow values that are close to $0, the financial benefit is similar for the military route and the private sector route.

In the sample table below, the scenario being compared is the private sector route without doing a residency to the military route without doing a residency assuming that the HPSP scholarship length is 4 years long. In this scenario, it is also assumed that in the private sector route, loans are refinanced at 3% upon graduation. Under the given parameters, the moment of comparison for this table is when the student completes their initial military service commitment and enters private practice 4 years after graduating from dental school (as compared to the private practice dentist just finishing their 4th year of private practice and also becoming debt-free at the same moment in time).

Students can input their own scenario for the private sector and military routes into the spreadsheet and create a custom heat table to determine the net financial benefit for various incomes and dental school costs of attendance.

Conclusion

The data presented in the Laptops For Military Docs HPSP Financial Analysis Calculator may or may not surprise you. For scenarios where a student is considering attending a very expensive private school, it was already widely accepted that the military route is the best route to take. However, for scenarios where it is less cut and dry, students can now use this financial analysis to determine which route would be more beneficial from a financial perspective.

In no way should this analysis serve as the single deciding factor on whether to accept the HPSP scholarship or not. It is a powerful tool to evaluate both routes from a strictly financial perspective. However, many more factors should be considered in deciding whether or not to go the military route including quality of life, job security, scope of practice, and desires to serve your country.

The Laptops For Military Docs HPSP Financial Analysis Calculator supports the following conclusion:

"For the private sector route to be more financially beneficial than the military route, a combination of a low cost of attendance and a high private sector income is necessary. If this combination does not exist, then taking the military route is financially more beneficial."

As a final example from the table above, someone with an initial cost of attendance of $60k per year would need to make an average of over $200k per year over the course of their first 4 years as a private sector dentist to achieve the same financial standard of living during those 4 years as someone who went the military route. This is doable, but other factors must also be considered for the private sector dentist to achieve this income, including late nights, working overtime, and stress of running a practice – all things that don’t exist in military dentistry.

Was this financial analysis calculator helpful in deciding whether or not to accept the HPSP Dental Scholarship? We’d love to hear your thoughts in the comments below!